- Solutions

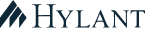

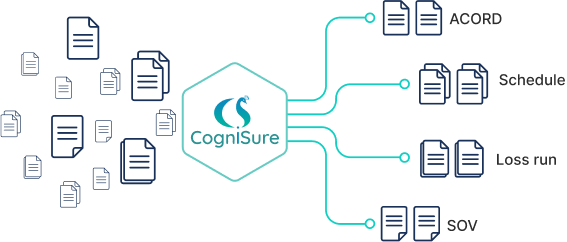

Submission Insights

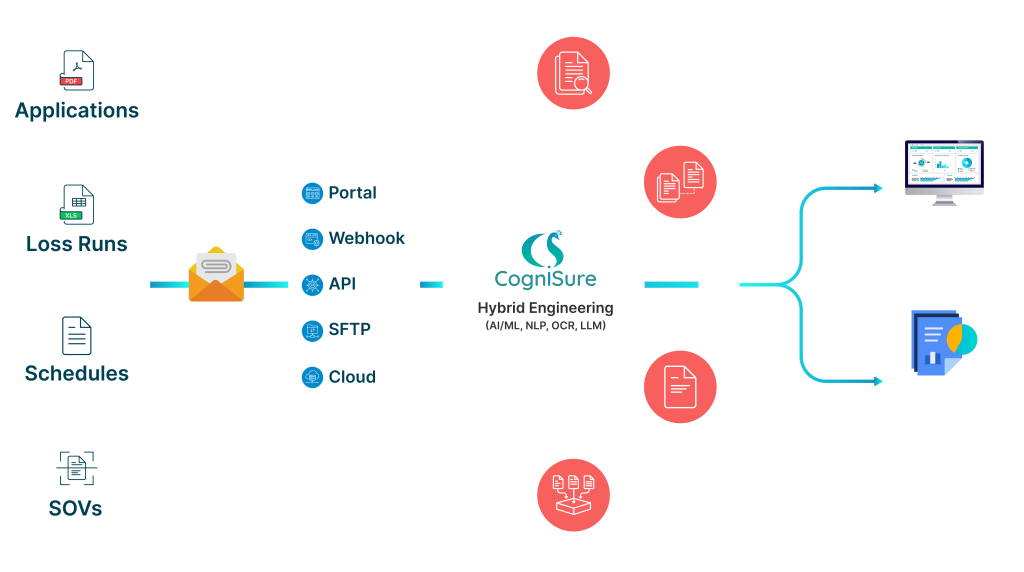

Your pathway to smart and efficient underwriting

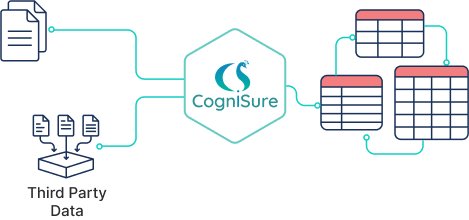

Loss Run Insights

Empower smarter risk decisions with Loss Runs

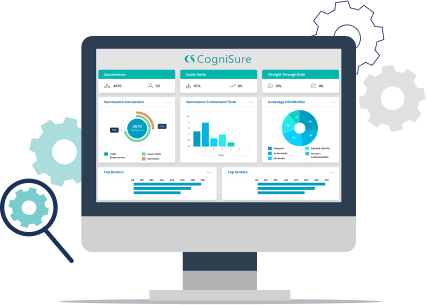

Benefits Insights

Unlock Insights with automated Financial Monthly Reporting (FMR).

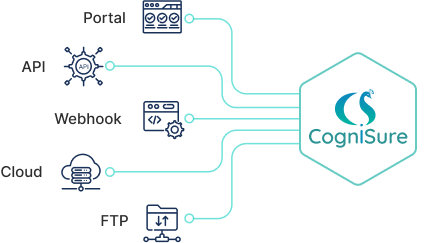

- Platform

- Resources

Press Releases

What's happening in CogniSure

Webinar & Events

Elevate Your Expertise: Tune into Our Engaging Webinars.

- About Us

Who We Are

A team changing the future of insurance

Careers

Join the CogniSure Team for exciting growth opportunities